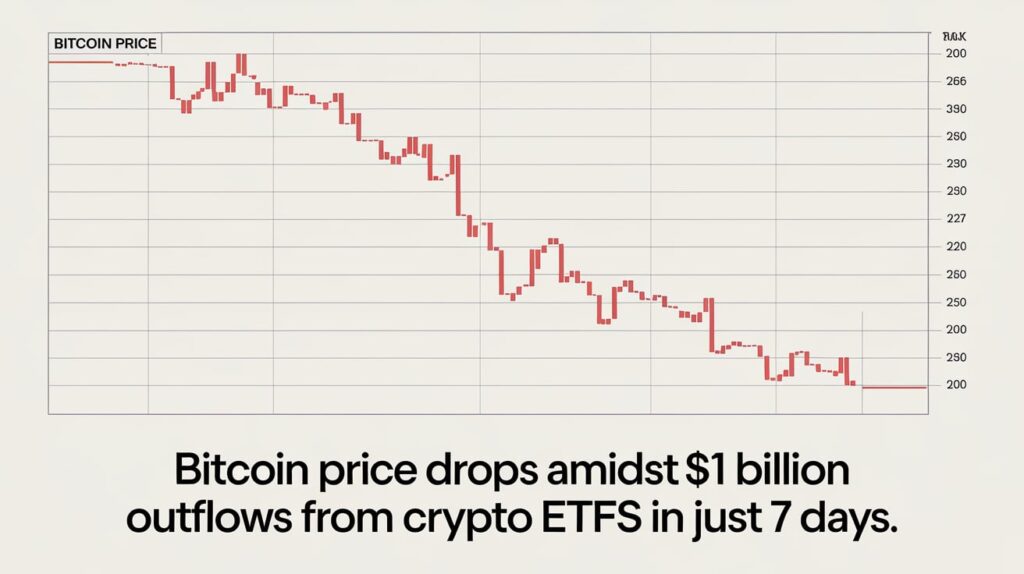

Bitcoin Price Drops Amidst $1 Billion Outflows from Crypto ETFs in Just 7 Days.

Introduction-

In recent days, Bitcoin has experienced a notable decline in its price, a development closely tied to significant outflows from cryptocurrency exchange-traded funds (ETFs). Over the past week, these ETFs have recorded a staggering $1 billion in outflows, which has had a direct impact on Bitcoin and the broader crypto market. This article delves into the reasons behind this sharp decline, the implications for investors, and the potential future trends in the cryptocurrency landscape.

Understanding the ETF Outflows

Exchange-Traded Funds (ETFs) have become a popular vehicle for investors seeking exposure to cryptocurrencies without directly purchasing the assets themselves. These funds are designed to track the performance of a specific asset or index, and in the case of crypto ETFs, they offer a way to invest in digital currencies like Bitcoin through traditional financial markets.

Recent data reveals a significant trend: over the past seven days, crypto ETFs have seen approximately $1 billion in outflows. This substantial withdrawal of funds from these ETFs suggests a shift in investor sentiment or a reaction to market developments.

The Impact on Bitcoin Price

The outflows from crypto ETFs have had a tangible impact on Bitcoin’s price. As investors pull their money out of these funds, it creates a ripple effect in the market. The selling pressure from ETF withdrawals can lead to a decrease in demand for Bitcoin, causing its price to drop.

In addition, the decline in Bitcoin’s price can be attributed to a combination of factors including market sentiment, regulatory news, and macroeconomic conditions. The ETF outflows are a significant piece of this puzzle, but they are not the only factor influencing Bitcoin’s valuation.

Reasons Behind the Outflows

Several factors may have contributed to the recent $1 billion outflows from crypto ETFs:

- Market Volatility: Cryptocurrency markets are notoriously volatile. Significant price swings can prompt investors to reassess their positions and move their capital to safer assets or different investment opportunities.

- Regulatory Concerns: Ongoing regulatory scrutiny and potential regulatory changes can create uncertainty in the market. If investors perceive increased regulatory risks, they might withdraw their investments from crypto ETFs.

- Profit-Taking: After a period of substantial gains, some investors might choose to lock in their profits by selling their ETF holdings. This can lead to a temporary surge in outflows.

- Shifts in Investment Strategy: Investors may adjust their strategies based on changing market conditions or personal financial goals. For instance, some might pivot from ETFs to direct investments in cryptocurrencies or other asset classes.

Historical Context and Comparisons

To understand the significance of the recent outflows, it’s helpful to look at historical data. In the past, significant ETF outflows have occasionally coincided with downturns in cryptocurrency prices. However, the scale of the recent $1 billion outflows is noteworthy and suggests a more pronounced shift in market dynamics.

Comparing the current situation to past trends, it’s evident that while outflows have impacted Bitcoin prices before, the current scenario is marked by a rapid and sizable withdrawal, indicating heightened investor caution or dissatisfaction with the market conditions.

Market Reactions and Investor Sentiment

The cryptocurrency market is highly sensitive to investor sentiment. The recent ETF outflows have likely contributed to a bearish outlook among traders and investors. As Bitcoin’s price drops, it can trigger a cascading effect, where fear of further losses leads to additional selling and further declines in price.

Investor sentiment plays a crucial role in cryptocurrency markets. Positive news can drive prices up, while negative news or market behavior can lead to sharp declines. The current situation underscores the importance of monitoring market sentiment and understanding how macroeconomic and regulatory factors can influence investment decisions.

Future Outlook for Bitcoin and Crypto ETFs

Predicting the future of Bitcoin and crypto ETFs involves analyzing current trends and potential market developments. While the recent outflows and price decline are significant, they do not necessarily indicate a long-term bearish trend. Market conditions can change rapidly, and there are several factors that could influence future price movements:

- Regulatory Clarity: Clear and favorable regulatory developments could restore investor confidence and attract new capital into crypto ETFs, potentially stabilizing or increasing Bitcoin’s price.

- Technological Advancements: Continued innovation and technological advancements in the cryptocurrency space can positively impact market sentiment and investment flows.

- Macro-Economic Factors: Broader economic conditions, including interest rates and inflation, will continue to affect investor behavior and cryptocurrency markets.

- Market Recovery: Historically, the cryptocurrency market has shown resilience and the ability to recover from downturns. It’s possible that the current decline could be a temporary phase before a potential rebound.

FAQs

1. What are crypto ETFs?

Crypto ETFs are exchange-traded funds that track the performance of cryptocurrencies like Bitcoin. They offer investors a way to gain exposure to digital currencies through traditional stock exchanges without needing to buy the actual cryptocurrencies.

2. Why did crypto ETFs experience $1 billion in outflows?

The $1 billion outflows from crypto ETFs can be attributed to various factors including market volatility, regulatory concerns, profit-taking, and shifts in investment strategies. Each of these elements can impact investor decisions and lead to significant withdrawals.

3. How do ETF outflows impact Bitcoin’s price?

When investors withdraw funds from crypto ETFs, it can create selling pressure on the underlying assets, including Bitcoin. This increased selling activity can lead to a decline in Bitcoin’s price as demand decreases.

4. Is the recent Bitcoin price decline a sign of a long-term trend?

While the recent decline is significant, it’s not necessarily indicative of a long-term bearish trend. Cryptocurrency markets are highly volatile, and price movements can be influenced by a range of factors. It’s important to consider broader market conditions and potential future developments.

5. What should investors do in response to the current market conditions?

Investors should carefully assess their strategies and consider their risk tolerance. Diversification, staying informed about market developments, and seeking professional financial advice can help navigate the volatility and make informed investment decisions.

Conclusion

The recent decline in Bitcoin’s price, coupled with $1 billion in outflows from crypto ETFs, highlights the complex interplay between market dynamics and investor behavior. While the current situation reflects a challenging period for Bitcoin and the broader cryptocurrency market, it also presents opportunities for those who closely monitor market trends and adapt their strategies accordingly. As always, staying informed and understanding the factors driving market movements are crucial for making sound investment decisions in the ever-evolving world of cryptocurrencies.